Investment Planning

One of the basic responsibility of the owner/operator is the realisation of capital project for profitability and sustainability of the refinery, and to ensure the right project are selected in compliance with the company’s business strategy, future trends in the market.

It is clear that any refinery without investments cannot survive to meet the changes in demand and other requirements (environmental limitations, changes in product specifications, legal requirements, product diversification, etc).

Clearly the most important parameter/step for the profitability of any project is the initiation of the projects (Investment Planning) where the requirements and other basic requirements are defined (what would be the products to be produced and specifications, capacities and other targets). For example, for a project for utilisation of HVGO, the route (FCC, high severity FCC for product diversification or Hydrocracker) has more impact on profitability then the selection of technology for the selected route (and so the risk associated with the project).

The technology selection is the second most important step impacting the profitability of the capital investments for the project. The remaining steps of the investments are the secondary parameters in terms of the impacting the profitability. The degree of impact reduces with the remaining steps.

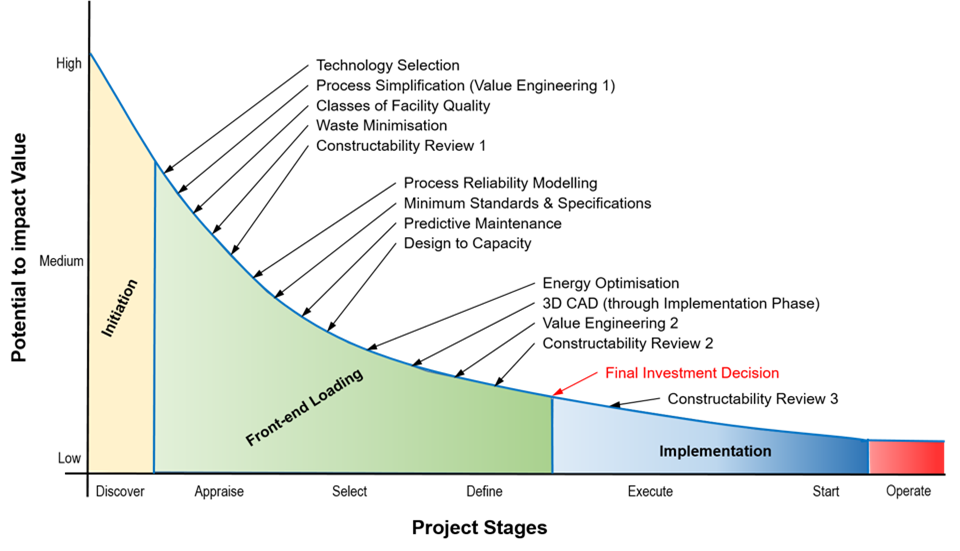

The chart below shows the project steps and their potential to impact the profitability.

Porter, J.B. jr., 2002, DuPont’s role in capital projects. In Proceedings of Government/Industry Forum: The owner’s role in project management and preproject planning. National Academy Press, Washington D.C.

Conceptual Design:

During the conceptual design the parameters to be considered are;

- Present condition of the refinery/company,

- Future demands projections, demands,

- Targets of the refinery/ company- such as meeting the product specification and demands, compliance to any limitations, utilisation of intermediate products such as HVGO, residues, product diversification. All should be focusing on the sustainable profitability of the refinery,

- Actual and future environmental limitations,

- Available routes to that target, All of the alternatives without any limitation should be on table,

- Land availabilities,

- Infrastructure,

- Others, if any

The process of this stage is somehow not very complicated and straight forward but is the most important stage for any investment project.

The main steps are;

Definition of the existing situation: This is not a fixed state and should be as dynamic as possible to represent the existent refinery for different situation. In simple words, there should be, an LP model (PIMS or others) describing refinery correctly. This is needed to simulate the refinery production capability (product slate and cash flow) for different situation. İf there are more than one refinery, then a multi refinery LP model should be preferred.

Definition of alternative routes: For the targets set, all the available technologies should be defined, and different refinery configurations should be set, and all the available technologies should be incorporated to the existing refinery model to simulate the refinery capability for different situations.

Assessments of Alternative Routes: This is a comparison step of different routes to the existing situation. This comparison should be done for different price scenarios.

Selection of the Final Route for Investment: This based on IRR, NPV and IIRR techniques and it is highly recommended to have risk based assessment for final decision. In this risk based assessments the IRR; NPV and IIRR are to be calculated for various CAPEX and product price scenarios. typically, more than 5000 scenarios can be evaluated.

Although it seems to be simple and straight forward, experience and expertise are prerequisites for successful result.

The work requires communication with the technology owners and contractors, communication with different departments of the company/refinery, modelling activities and financial evaluations.

Some important notes for a successful work;

- An LP model (validated) of the refinery or if more than one refinery a multi refinery model is more than a recommendation. İt is an essential part of the studies to be done.

If such a model is not present, either the Company can help client team to construct such models or The Company can construct such model in behalf of refinery. We have PIMS expertise and experience to do so.

- The yield structure and energy consumption figures for different raw materials or different operating conditions (shift vectors) for all the processing units to be included in the different routes are necessary for the LP modelling. İt is usually difficult to get them from licensors or technology providers. This information can be generated from the Company in house data with the supporting information from licensors. The company can also consult the client team to generate this information

- An appropriate financial tool is necessary to calculate the financial parameters for feasibility study. The company can generate such a tool for the client. Or can help the client to generate it.

- For risk based assessment a statistical tool has be used. This tool has to be purchased if not exist already,

- Demand projections for the future 10-15 yrs. and demand figures for the past 5-10 yrs. are to be considered,

- Price projections for future and prices for last 10 yrs. are to be considered,

- Capex figures for all the processing units to be included in the different routes are necessary. An estimate in the range of %40 should be enough to have the study,

As the Company, we are ready to fulfil all your requirements for a successful work either as a consultant on any stage of the works or as a provider for complete package as client wishes. Alternatively, we can act as a member of the Client team or we can also lead the Client team. We can provide a complete report showing mainly;

- Yields and utility consumption figures of all the new units included in the different routes,

- Overall refinery product yields and utility consumption figures for all the routes evaluated in comparison with existing refinery,

- CAPEX estimates for all the routes, (+/- %40 ),

- IRR, NPV, IIRR for all the investment routes for more than >5000 price/cost scenarios in terms of the probability charts,

- Recommendations for the most profitable investment route and capacities of units included,

- A final presentation to explain all the report and discuss the result thereof,

Please see “About me” section for some of the references.

Feasibility Studies

Feasibility studies are intergral parts of both the Investment planning and the Technology selections.

Feasibility studies are intergral parts of both the Investment planning and the Technology selections.

The company can establish any kind of feasibility studies for any kind of investment projects.

Technology Selection

The main objective of the technology selection is to find the best technology available which fits well with the targets set by clients and maximise the profit in a sustainable manner from the unit.

The main parameter to be considered should be operational net benefit from the unit expressed in terms of NPV, IRR (which inherently includes income, CAPEX, Licensor Costs, Catalyst Costs, Utilities, etc).

It is worthy to state that the reliability and safety issues are primary factors and inherently included in the word “sustainability” and therefore it is not stated separately.

The main steps for the selection of Technology and Licensor are;

- Defining the licensor list,

- Preparation of the Technical specification for the project including Basis of Design, Scope of licensors, Guarantees and Associated Liabilities, Services and instruction to bidders for the quotation/proposals,

- Preparation of commercial Specifications (detailing the payments terms, taxes etc),

- Issue Request for Proposal,

- Management of Licensor Bidding and Technical and Commercial Query process,

- Technical and Commercial Evaluations,

- Clarification and Screening,

- Selection of preferred Licensor(s),

- Negotiation of Terms,

- Award of Licenses.

During the selection process, the agreements to be executed with the selected licensor should be completed/finalised by correspondences /meetings with all the likely licensors and before the final selection, these agreements should be ready to execution.

Some of the important considerations on selection are;

- The most important selection criterions should be the economical evaluations (which inherently includes income, CAPEX, Licensor Costs, Catalyst Costs etc,) and it should be done for the overall refinery,

- The comparison should not be done just by comparing the unit(s) in consideration but should focus on the impact on overall refinery yields and utility consumptions. So, for the economical evaluations overall refinery production pattern should be generated using an LP model for all the offers and comparisons with the base condition of the refinery (usually the actual condition) should be done in accordance.

By doing this, the refinery production slate and all the needs (utilities and requirements for accompanying supporting units) are defined.

The last step should be the calculation of financial parameters such as IRR, NPV, IIRR for all the offers.

- The Reliability and Safety issues are in equal importance and for any unit and it is unlikely to have such a proposal where the reliability and safety are an issue since the licensor list is already generated based on the reliability and known companies,

- Land Requirements,

- Flexibility,

- References of the unit(s) proposed for different time periods such as, total number of units licensed, total number of units in operation, total number of units licensed for the last 5 yrs.

One of the key step for a successful selection of technology is the preparation of the technical specification, as it defines the requirements of the client and scope of the Licensor and these requirements should be clearly explained to minimize the later correspondences and any misunderstandings.

A high quality, clear technical specification is a prerequisite for a complete and high-quality proposal.

We as the Company, can participate all the steps as a consultant or as a team leader but it is also possible to manage all or each part as a package, excluding the commercial specifications.

We have the extensive experience with all the major licensors such as UOP, Axens, Shell Global Solutions, Foster Wheeler, Chevron Lummus Global, Merichem, Technip.

Please see “About me” section for some of the references.